High Hopes: How Breweries Are Tackling THC Drinks | Imbibe Magazine

This article was published in 2024 in Imbibe magazine.

One fruitful day in 1911, New York State dairy farmer Andrew Beak met onion grower George Skiff. They established Beak & Skiff Apple Orchards in hilly LaFayette, about 20 miles southwest of Syracuse, initially supplying wholesale apples for grocery stores. Betting a farm’s finances on one crop can be climatically fraught. “We have 1,000 acres of apple trees,” says president Eddie Brennan, part of the family business’s fifth generation. “One cold night, you can lose half of your crop.”

Beak & Skiff began diversifying in 2001 with 1911 Established hard ciders, later adding spirits and wine. “We have a farm, but we’ve become a beverage company,” Brennan says. The evolution requires Beak & Skiff to meet, and anticipate, drinkers’ evolving desires. The federal government’s 2018 Farm Bill, which lifted the ban on cultivating hemp, led Beak & Skiff to produce sparkling waters infused with CBD, a non-psychoactive compound in cannabis and hemp.

After New York State legalized recreational cannabis in 2021, Beak & Skiff created sister company Gen V Labs the following year, carving out acreage to grow cannabis and produce vapes, edibles, and beverages containing THC, the plant’s mood-altering compound that delivers a high. The Ayrloom drinks, which debuted last year, include flavored sparkling waters, vanilla cola, and Honeycrisp cider pressed from Beak & Skiff apples. “It’s the most physical representation of what we do,” Brennan says, as well as another fiscal safeguard for the farm. “We need to make sure we’re hedging against the declining consumption of alcohol.”

America’s most broadly available recreational drug is CH₃CH₂OH, better known as ethanol. It’s in every alcoholic beverage, from hard seltzer to mezcal, hazy IPAs, red wine, and those plastic bottles of Fireball. But sales of beer and wine are sliding, and Generation Z is not coming of age at keg parties. Nonalcoholic breweries and brands (Athletic Brewing, Guinness 0) and prebiotic soda makers (Olipop, Poppi) are gaining popularity, and bars and restaurants are curating compelling menus of alcohol-free cocktails. The industry buzz isn’t one.

Or maybe it just needs a molecular makeover. Breweries, cideries, and upstart beverage companies are producing drinks containing C₂₁H₃₀O₂, or THC, derived from cannabis and its cousin hemp. (The chemical makeup of THC is identical in both plants.) The drinks, which are sold to 21-and-up consumers, cut away cannabis stigmas by eliminating the divisive elements, such as a joint’s smoke or getting too stoned after eating edibles, and recasting cannabis as a micro-dose drink with around two to five milligrams of THC per serving—about as intoxicating as a light lager. “People want things that are sessionable, and weed is not an exception,” says Shelby Poole, the marketing director of Happy Days Dispensary in Farmingdale, New York.

***

Early THC beverages of the 2010s had a mixed track record. THC is a fat, meaning it won’t mix with water. Like making salad dressing, THC is emulsified to become water-soluble. THC emulsions might separate or have intensely bitter, earthy flavors that beverage makers masked with sugar; sodas were a common delivery vehicle for THC. Technology and know-how have vastly improved, and suppliers like Vertosa are now creating more flavor-neutral emulsions with faster onset times of about 15 to 20 minutes. Effects wear off in a few hours, making it reminiscent of alcohol.

Who is better suited at producing flavorful, not-too-intoxicating beverages than breweries? Wherever legal, breweries are tackling THC drinks to boost sales and cultivate new audiences. In California and Colorado, Lagunitas Brewing has Hi-Fi Sessions, while Bale Breaker Brewing offers Sungaze Cannabis Seltzer in Washington State. In 2022, soon after Minnesota legalized beverages and edibles containing hemp-derived THC, Indeed Brewing in Minneapolis began producing sparkling THC beverages. Today, the brewery’s THC offerings, including the Pistachio Dream modeled on its Pistachio Cream Ale, account for more than 10 percent of its revenue. “It’s a huge boon to a craft brewery to have a beverage that fits their brand,” says chief business officer Ryan Bandy.

Minnesota is experiencing a green rush of breweries and cideries, including Modist Brewing, Fair State Brewing Cooperative, and Minneapolis Cider Company, that are producing THC beverages and gummies. One popular supplier of hemp-THC emulsions is Superior Molecular in White Bear Lake, just northwest of Minneapolis. “We started with one or two clients, and now we have more than 250,” says CEO John Dugas, who founded the company in 2017. Superior Molecular now counts customers in Iowa, South Dakota, and Wisconsin, and the biggest clients are not always big breweries. “It’s really about how well they know their customers,” Dugas says. Superior’s emulsion success stories, like Oliphant Brewing in Somerset, Wisconsin, are using fruit purées to create THC beverages as bold as their beers. When everyone is using the same psychoactive substance, “there needs to be differentiating factors,” Dugas says.

Many THC drinks are seltzers, tasting not unlike LaCroix with something extra. They’re relatively simple to formulate, produce, and package, often taking less than 24 hours. The ease has led to “a baseline introductory product that’s flooding the market,” says Paul Weaver, the head of cannabis at Boston Beer Company. The moment is similar to hard seltzer’s early craze, when seemingly every brand, including Boston Beer’s Truly, offered a 100-calorie black cherry version. In 2022, Boston Beer entered the THC-beverage space in Canada, where cannabis is federally legal, with cannabis-infused iced teas named TeaPot. Call it Twisted THC. Flavors like black tea and lemon are drawn from the company’s boozy Twisted Tea. “Taste still matters most, more so in cannabis drinks than any other form,” Weaver says. Smoking a joint or nibbling a gummy is fleeting. “A cannabis drink is a prolonged experience.”

Crossing the THC-alcohol divide is a two-way street. Over the last four years, Tilray Brands, which is Canada’s leading recreational cannabis company, has been on a brewery buying spree, purchasing SweetWater and Montauk, plus eight breweries and brands from Anheuser-Busch InBev, including Blue Point. Because Tilray trades on the Nasdaq stock exchange, it’s prohibited from producing domestic cannabis products. Diversifying into beverage alcohol helps Tilray bolster its bottom line while awaiting legalization. “It’s interesting to sit on the sidelines in first-row seats and watch how everybody’s trying to maneuver,” says Ty Gilmore, the U.S. beer division president of the Tilray Beer subsidiary.

Ben Meggs founded Bayou City Hemp Company in Houston, Texas, in 2019, and the vertically integrated company extracts hemp THC, makes emulsions, and produces brands such as the THC seltzer Howdy. One key omission was a retail footprint, a place for customers to buy and sample its brands. In 2022, Bayou City partnered with Houston’s 8th Wonder, a brewery and a distillery, to create a brick-and-mortar dispensary selling Bayou City’s brands. The success led Bayou City to buy 8th Wonder in 2023, and revamp the taproom with a cannabis-drinks focus. “We’re going to lean into being a consumption lounge,” Meggs says. “It allows us to give consumers a real experience to educate them.”

Guests can drink 8th Wonder’s Dome Foam cream ale alongside mocktails made with Bayou City’s THC-infused nonalcoholic agave spirit. With as many as 10,000 guests passing through the taproom during busy weeks, Meggs can pinpoint unexpected consumer preferences. Guests in their 60s are gravitating toward Drippy, a THC soda sold in Strawberry Haze. “I wouldn’t know it if I didn’t see all these glasses with pink juice,” Meggs says.

***

Sales pathways for alcoholic beverages are well defined. Broadly speaking, smaller breweries, distilleries, and wineries might self-distribute, or partner with distributors to transport products to wholesale accounts. Many companies legally ship hemp-THC drinks to customers, but mailing heavy liquids is expensive. And traditional distributors can be hesitant to sell THC drinks. (The National Beer Wholesalers Association declined to comment for this article.)

“It’s a patchwork of regulations,” says Jacob Landry, the founder and CEO of Urban South Brewery, which has locations in New Orleans and Houston. “Our bigger distributor networks don’t want to touch it right now.” Not all retailers are as wary. About a year ago, Landry noticed that Rouses Markets, which has more than 50 Louisiana locations, was carrying THC seltzers. Perhaps that could be a guaranteed placement? Urban South acquired a $175 permit in Louisiana, where hemp-derived THC is legal, and created the zero-calorie THC seltzer Driftee. It debuted in December at Rouses, and it’s also sold at the taproom and new accounts like coffee shops. “We know how to get retailers to pick up our products,” Landry says.

The sales playbook for THC beverages is being written in real time. In 2019, Jake Bullock and Luke Anderson launched Cann, their micro-dose THC drink, in California cannabis dispensaries, competing with potent edibles, vapes, and flower. The friends envisioned Cann as a hangover-free alcohol alternative, delivering a subtle buzz during social occasions. “That decision is much easier when it’s sold alongside alcohol,” Bullock says. As state regulations evolve to permit sales of hemp-THC drinks, so have Cann’s opportunities to land placements outside dispensaries. Craft beer distributors like Sarene, which services five states including New York and Pennsylvania, are helping place Cann in alcohol-adjacent spaces like supermarkets and convenience stores.

There’s no trusty schematic for stocking THC drinks, though. Upon launching in New York City bodegas, for example, Cann was stocked by single-serving juices. “That’s the flex space where they can try new products,” Bullock says. If Cann drinks sell, perhaps they’re moved into coolers alongside competitors like Wynk, a THC seltzer. That’s a boon. “It feels like a real category instead of, what’s this weird thing tucked behind the orange juice?”

Increasingly, hemp-THC drinks are carving out shelf space in liquor stores in Texas, Connecticut, and Minnesota, including large retailers like Total Wine & More and independent stores. “We’re legitimizing a category to customers that weren’t necessarily walking into a dispensary to shop,” says Jon Halper, the owner and CEO of Top Ten Liquors, a 14-store chain in and around Minneapolis. Sales of THC beverages and edibles make up roughly 10 percent of Top Ten’s sales, and THC beverages “naturally slip their way” into carts filled with beer, wine, or spirits. Unlike cannabis dispensaries, customers can use credit cards to buy THC beverages alongside alcohol. “It’s all part of the same legal experience,” Halper says. (Credit card companies forbid customers from purchasing illegal services or substances.)

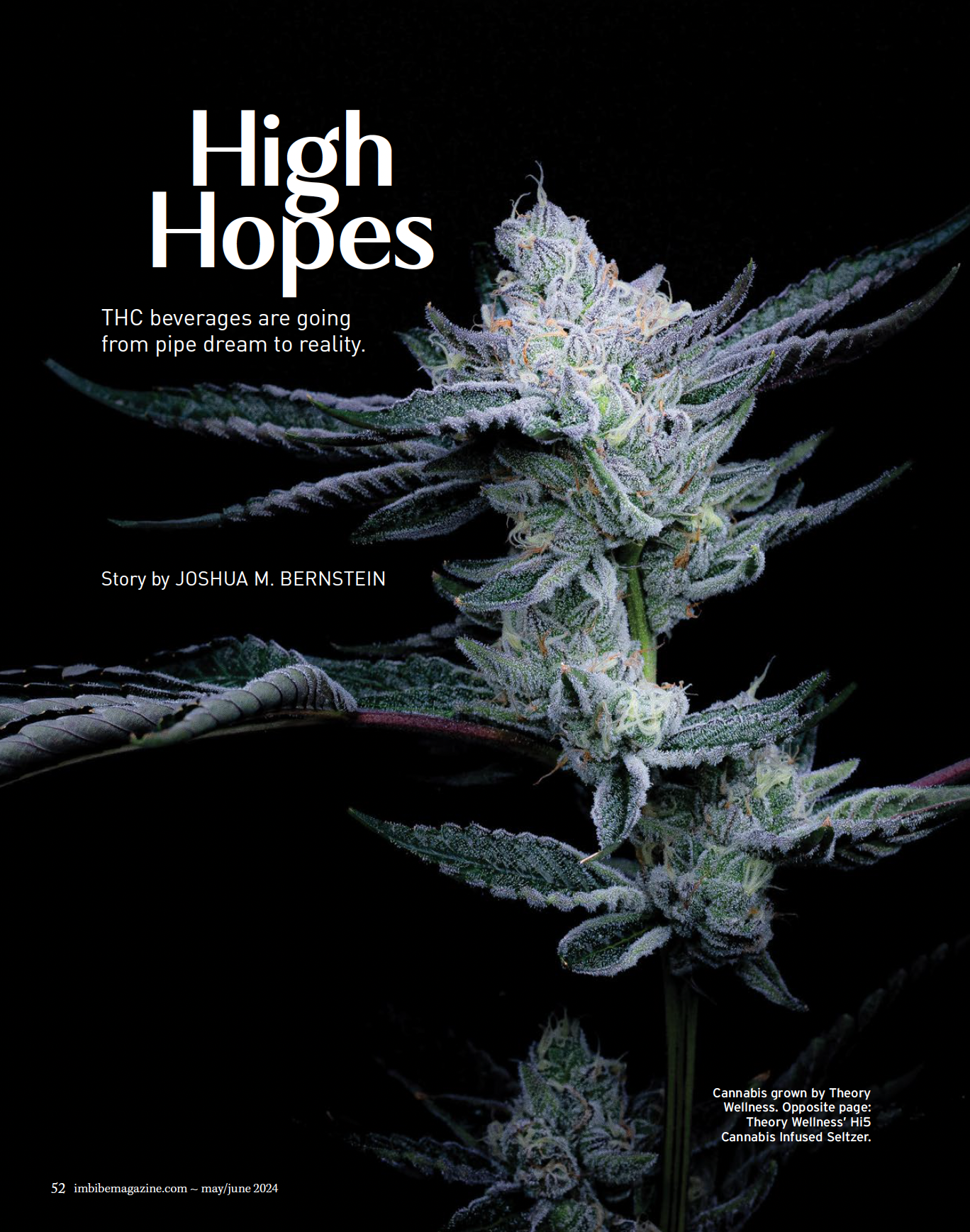

Dispensaries are also putting drinks front and center. In January, Theory Wellness opened the country’s first beverage-only dispensary inside a former car dealership in Medford, Massachusetts, just northwest of Boston. Named after one of Theory’s THC drinks, Hi5 Beverage Dispensary streamlines retail, eliminating lengthy menus in favor of see-through coolers stocked with wholesale-priced cannabis beverages. A four-pack of infused seltzer might sell for as little as $6. “We wanted to provide a price point that was digestible,” says Thomas Winstanley, Theory’s chief marketing officer. The store aims to make buying cannabis beverages as “common to customers as buying a four-pack or a six-pack at a liquor store.”

***

If you’re buying a THC beverage, you can choose from seltzers, caffeinated powders, lemonades, tinctures, sodas, and more. Form, flavor, and strength are scattershot as companies try to zero in on the preferred delivery mechanism for drinking THC. Channeling familiar alcoholic beverages can ease the path to adoption.

In 2021, Darnell Smith debuted MXXN (pronounced moon), a line of alcohol-free, cannabis-infused spirits that are analogs to tequila, bourbon, and gin. MXXN spirits are designed to be mixed and sipped like cocktails, an ingrained familiarity that fosters understanding. “It’s easy for me to ask someone, ‘Are you familiar with gin? Go use this in place of gin and let me know what you think,’ ” Smith says. “It’s a much heavier lift to try to create a whole new vernacular.”

Cocktails are also favored by Pamos, which makes a citrusy THC spirit suited for a spicy Margarita and canned spritzes modeled on the Mai Tai. Pamos is on menus at bars and restaurants from Texas to New York, plus Alabama’s Sassy Bass chain. “When you start to get requests from Alabama-coastline restaurant chains, the cat is out of the bag,” CEO and co-founder David Mukpo says. This spring, Pamos also aims to start selling canned THC cocktails at sports venues such as Amerant Bank Arena in Sunrise, Florida (home to the NHL’s Florida Panthers), where they’ve recently posted signage. “It will be the first time that 20,000 people can walk into a stadium and make a decision between alcohol and cannabis,” Mukpo says.

Alcohol’s physical effects are well documented and uniform. THC’s psychoactive impact can differ from person to person. “There’s a wider variance than what we see with alcohol,” says the Cannabis Beverage Association’s Eberlein, adding there is a trial-and-error element to THC drinks. “You have to learn your tolerance and how certain things impact you.” Variability in strength is a potential snag. A packaged beer’s aromatics might evolve over time, but the ABV is static. A canned THC drink can lose its psychoactive heft from oxidation, which makes THC transform into a non-intoxicating compound.

“Oxygen has a direct impact in the potency stability,” says Shreyas Balakrishnan, the CEO of Blaze Life Holdings. In January, the California company opened DeltaBev, a cannabis-beverage production plant focusing on increasing efficiency and minimizing oxygen during packaging. The facility produces brands including Mary Jones, the infused sibling to Jones Soda, and distributes them to dispensaries. Co-packers like DeltaBev offer an answer to federal rules forbidding cannabis from crossing state lines; to be sold in dispensaries, cannabis beverages must be manufactured in each state.

THC brands with national aspirations must stitch a countrywide quilt of packaging partners. To ensure consistency, Cann makes concentrated flavor syrups (grapefruit rosemary, lemon lavender) at a Texas facility, then ships them frozen to manufacturers for infusion and canning. (DeltaBev produces Cann in California.) In Texas, Cann also produces hemp-derived THC drinks for national distribution, affixing different labels depending on each state’s requirements. “In some states you have to say cannabis, and in other states you cannot say cannabis,” Bullock says. “Your head is spinning.”

Onerous legal requirements and production challenges can hamstring start-ups. In 2018, after three decades at Molson Coors Beverage Company, Blue Moon creator and master brewer Keith Villa left to create THC-infused nonalcoholic beer. Ceria Brewing’s Grainwave Belgian-style white ale was sold in Colorado and California dispensaries, but the roundabout route to market—alcohol-free beer was shipped to copackers for infusion—and added expenses, including special child-resistant caps, led Ceria to cease production in 2022. “To be successful in the brewing industry, it’s more efficient to have a large amount of production and ship across state lines to other markets,” Villa says. Ceria now focuses on its alcohol-free beers sold in around 20 states, and Villa is waiting for federal legalization before trying again with THC beer. “We’re in standby mode.”

Beverage brand Recess debuted in 2018 with CBD drinks containing stress-reducing adaptogenic herbs, which now account for less than 10 percent of the company’s sales. Recess is prioritizing zero-proof mocktails and the magnesium-packed Mood sparkling waters. “We’re really a healthy relaxation brand,” says founder and CEO Ben Witte. The shift from cannabis-adjacent compounds has helped land Recess in large retailers ranging from Target to Safeway and Amazon. “We’re in 15,000 retail doors,” Witte says. “That’s not CBD.”

Laws evolve glacially in America, especially concerning controlled substances. The government repealed Prohibition in 1933, but alcohol regulations remain under constant renovation. Just last year, Wisconsin allowed wineries to stay open as late as bars (2:30 a.m. on weekends!), and New Jersey recently removed the prerequisite that brewery guests take a tour before buying beer. Anyone making THC drinks must be comfortable contending with laws as stable as quicksand. “We’re still in this flux in the regulatory environment,” Bullock says.

Consumer acceptance is also unpredictable. When Beak & Skiff began exploring CBD and THC beverages, some longtime customers expressed their reservations through pointed emails and phone calls. “There’s this idea that it’s still a gateway drug into other drugs, and that we’re some type of a modern drug dealer,” Brennan says. But a can of a cold THC cider in hand, cracked with friends that might be drinking beer or wine, could uproot cultural assumptions about cannabis and hemp. When there’s no smoke, there might be less ire. Says Eberlein of the Cannabis Beverage Association: “Cannabis beverages can be the gateway for cannabis acceptance overall.”